Monetization project | Gensol Engineering Limited

Define your ICP and Product

Wayo is On-Demand Intracity logistics platform that allows users {can be businesses (SME's/retail stores) or individuals} to transport anything (from a document to a king-size bed - wide range of vehicles from 2W to 8ft) from point A to point B (within the same city as of now) in a safe (our drivers are verified - background check is done) and cheap manner

Features:

Users can also use the application for the following use cases:

- Scheduled vs On-Demand: Users can schedule deliveries or can send goods on a real time basis

- Point-to-point vs Multi-stop: Users can transport goods from a single point of multiple points within the same city

Current Limitations:

- Intercity trips are not allowed; Mostly services are within the same city

- Specialization isn't allowed as of now- POD, Cash Handling; Loading/Unloading

What is the problem being solved by the product?

For Customers:

- Customers can get a wide assortment vehicles to deliver any types of goods across the city

- Transparent and fair pricing

- Live tracking of goods

- Professional and well trained drivers - ensure safety of goods

- Vehicle availability anytime during the day

For Drivers:

- Ease of doing business - can turn online/offline as per their convenience

- Instant payment - in an industry which generally runs on credit

- Transparent Wallet which helps the driver understand his earning

- Stable source of earning

- Can start earning while going online - doesn't have to be at the mercy of his local customer network

Know your ICP:

Parameter | ICP 1 | ICP 2 |

|---|---|---|

Name | Mr. Amit Gupta | Mr. Pranav Dev Singh |

Demographics |

|

|

Profile |

|

|

Vehicle Owned | 3W Load carrier - Bajaj Maxima | 3 - 3W- Baja Maxima 1- 4W -Tata Ace |

Problems Faced |

|

|

Originally from | Bihar | Uttar Pradesh |

Solution to the problem |

|

|

Technical Competence |

|

|

General Working Hours | 11-12 hours a day | 9-10 hours/day |

What do they aren't working? |

|

|

Where do they spend their time online? |

|

|

How did they get to know about Wayo? |

|

|

What do they spend their time on? |

|

|

What do they spend their money on? |

|

|

If not Wayo, then what? |

|

|

What is the earning on the platform? |

|

|

Monthly earning potential |

|

|

Number of trips/day |

|

|

I have just taken the ICP among the truck (3W/4W) owners. There could be 2W drivers as well, but that is out of scope as we are charging a flat out commission from them

Among the above 2, we are primarily focusing on ICP 1 as that is ~85-90% of the onboarded driver base (owner driving the vehicle as well)

Power, Core, Casual User Segmentation:

We would further segment the ICP 1 into three segments - Casual; Core (Secondary); Power (Dedicated) Drivers

The definitions is as follows:

Parameter | Casual | Core (Secondary) | Power (Dedicated) |

|---|---|---|---|

Login Hours | 10-12 hours/week | 20-24 hours/week | 30-36 hours/week |

Order Acceptance % | 20-40% | 40-60% | 70-80% |

Weekly Earning | ~3-3.5k/week | ~8.5-9k/week | ~10-12k/week |

Number of orders on Wayo | 1-2 trips/day | 3-4 trips/day | 5-7 trips/day |

If not Wayo, then what? |

|

|

|

Monetization litmus test

- Retention Graph

- Depth of Engagement

- Willingness to Pay

1. Retention Graph:

The retention graph is as follows:

As per the graph, it turns out to be a smile curve, where the graph shoots up after M5. This is a good sign and we might be ready for monetization

2. Depth of Engagement:

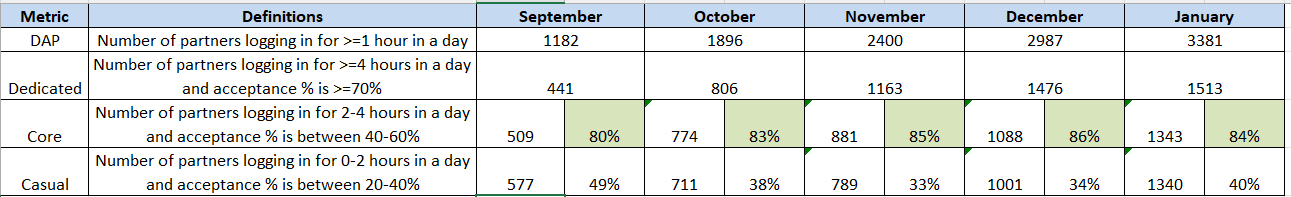

The Dedicated (Power) + Core users contribute to >80% of the daily active partners (logging in for >=1 hour in a day) for September to January

As per the litmus test, we are in the green here as well. Hence, we are okay to go forward with monetization for the particular set

3. Willingness to pay:

Breaking this into the steps mentioned:

List down all the ICPs:

That has been done in the section above

Define and select the ICPs that qualify:

As described above, we are focusing on ICP1 as that constitutes a large driver base. Also, among this ICP, we are focusing on the Core and Power users

Identify their problems:

Their problems have been listed in the above ICP bifurcation tab (marked in yellow)

Case-2: If the product is not yet monetizing but has passed the litmus test

Define your GTM strategy by identifying the right customer touchpoints and develop the right communications for these touchpoints.

GTM Strategy:

Points covered in the GTM Strategy are:

- What is your product?

- User Touchpoints

- How does it build trust among users?

- Why should the user choose us over the competition?

- How to best use your product?

What is your product?

Wayo is On-Demand Intracity logistics platform that allows users {can be businesses (SME's/retail stores) or individuals} to transport anything (from a document to a king-size bed - wide range of vehicles from 2W to 8ft) from point A to point B (within the same city as of now) in a safe (our drivers are verified - background check is done) and cheap manner

Users can also use the application for the following use cases:

- Scheduled vs On-Demand: Users can schedule deliveries or can send goods on a real time basis

- Point-to-point vs Multi-stop: Users can transport goods from a single point of multiple points within the same city

User touchpoints?

The driver has multiple touchpoints with the application. Some of them are:

- SMS

- Push Notifications

- BTL Branding: Vehicle Branding; Auto Branding

- In-App notifications

- Social Media: Facebook; Youtube

- Paid Ads: Gaming platforms; Payment Apps

How does it build trust among users?

It builds trust among the drivers in the following ways:

- Word-of-mouth: There are drivers that have been working with Wayo in his circle (~27% of the new onboardings are through referrals). The positive word helps builds trust amongst the driver base

- Transparent and easy to use wallet: The wallet is very easy to use. It shows the driver about his earnings, fare breakup and the components it comprises of

- Instant settlement to the wallet: Instant settlement of the order earnings, which the driver is able to withdraw to his bank account

- Easy support option: The CC (Call center) support is available for most part of the day, to whom the driver can reach out to for any live order/non-live order support

- Stable source of earning >> higher trust: Regular flow of orders, which drives trust among drivers as a stable source of earning

- Driver testimonials: Driver testimonials covering all types of pain-points of the drivers, leading to increased trust index

Why should the user choose us over the competition?

- More earnings for the driver: We don't charge commission on each order, unlike the competition, which allows the driver to keep all the earnings to himself. We, in-turn, charge a subscription fee (Daily/weekly) from the driver

- Unclear suspensions: We give proper visibility to the partners on their suspensions, in case they cancel after accepting the order, do a fraud order etc. The competition is unable to do that at this moment

We have a dedicated youtube channel with all the relevant info. We can check that out here

The youtube channel covers videos on:

- Order Lifecycle - how to complete the order

- Incentives that are running

- Subscription model

- RNR - Reward and Recognitions program

- Driver testimonials

Attempt has been made to approach the problem by looking at three key aspects:

- What are your users paying for?

- Where does your product stand out?

- How should you position your product?

What are your users paying for?

Our typical user is a driver cum owner who has bought the vehicle on EMI. This is deeply covered in the ICP section before

Drivers, if they want to continuously work for Wayo, would be paying for the following things:

Paying For? | Factors | Details |

|---|---|---|

Convenience | Ease of earning |

|

Instant Settlement |

| |

Stable source of earning |

|

Where does your product stand out?

Since the user for the product is the driver base, all the answers here are from the Drivers POV

This has been tried to be answered by enlisting the substitutes and comparing them across various parameters:

| Substitute/Factor | Ease of working | Needs physical effort? | Pricing | Core users | Earning Potential | Cash Fluidity | Earning Model | Tech Understanding Required | Major Pain point |

|---|---|---|---|---|---|---|---|---|---|

Wayo | Easy | Low | Rs. 40/km |

| Moderate - High | Easy to withdraw - can withdraw instantly | Subscription based - no commission charged on the every order | Moderate | Less demand - not enough orders as compared to other platforms |

Porter | Easy | Low | Rs. 42/km |

| Moderate - High | Easy to withdraw - can withdraw instantly | Commission based - take rate on each order | Moderate | High commission rates with lesser fares |

Local Naka | Easy - Moderate | Medium | Rs. 45/km |

| Low - Moderate | Might be some cases where cash gets stuck | No commission | Low - Moderate |

|

Fixed Contract | Hard - requires stringent SLA norms | Medium - High | Rs. 40/km |

| Moderate | Mostly works on credit - not fluid | No commission - final payout done after X days | Low | Credit cycle is very high |

How should you position your product?

Since out product offers convenience for the driver, as seen above, we would be charging him more on this.

Our charging model will not be subscription but a subscription model, which will help in better driver retention and supply build up

Monetization design

We checked the litmus test and found that we are ready for monetization (checking the retention curve and core and power user segment contribution to the Active partners)

In the following section, we will cover whom to charge in a little detail

Who to charge?

(Conduct an RFM Analysis and identify the users that you are monetizing and think about why them and not others?)

Step-1: Laying down the baseline scenario:

For the sake of simplicity, adding the image showing the MoM contribution of Power, Core and Casual drivers here:

Doing the calculation for the month of January

- Number of Power Users (Dedicated): 1513

- Number of Core Users: 1343

- Average Number of login days when Power Users in a month (Login >=1 hour/day): 20

- Average Number of login days when Core Users in a month (Login >=1 hour/day): 12

- Daily subscription charge - Power Users: Rs. 99/day

- Daily subscription charge - Core users: Rs. 49/day

We are also assuming an adoption factor. This is an estimate on the number of drivers who would be willing to pay for the daily subscription charge.

These assumptions are based on two key elements:

- The driver segment daily earning

- Take Rate of the competition

Segment | Daily Earning | Daily Subscription Amount | Adoption Factor | Rationale for adoption factor and the price point | Competition Take Rate |

|---|---|---|---|---|---|

Power | Rs. 2.5 - 3k | Rs. 99 | 30% |

| 15% on every trip |

Core | Rs. 1.5 -1.8k | Rs. 49 | 30% |

| 15% on every trip |

Revenue from subscription:

Revenue Generated/Month= (Number of login days) X (Number of Power Users) X (Adoption Factor) X (Subscription Charge/day)

Power Users:

Revenue = 1513 * 20 * 30% * 99 = Rs. 8,98,722 (a)

Core Users:

Revenue = 1343 * 12 * 30% * 49 = Rs. 2,36,905 (b)

Net Revenue: (a) + (b) = Rs. 11,35,627

Step-2: Test their elasticity:

Based on the segments we are choosing - Power and Core, the price is already mentioned in the above table. Also, the rationale for choosing the adoption factor has been mentioned above

RFM Plot:

I have tried to tweak the RFM Plot in a minor way. The proxies and the rational I have taken are as follows:

Initial Parameter | Proposed Parameter | Why the tweak? |

|---|---|---|

Frequency | Average Number of login days for the partner |

|

Step-2: Define the price points:

We would be charging from two segments: The Power and Core users

The price points and the rationale for those price points have been mentioned above

When to charge?

In this section, we will deep dive into another fundamental question: When to charge

Step 1: Identifying which aspect determines value for your product

There are many aspects that the drivers see useful in our platform. Deep diving into those with the help of a table as below:

Value determined through? | Details | Explanation |

|---|---|---|

Extra Earnings | Stable source of income |

|

Convenience - Time Saved | Aggregated demand |

|

Instant Settlement |

| |

Increased Efficiency | Efficient asset utilization |

|

Step 2: Competitor benchmarking

A detailed comparison between the competition and us is laid out:

Competitor | Earning Potential | Ease of usage | Payment cycle | Revenue Model | Vehicle Utilisation |

|---|---|---|---|---|---|

Porter |

|

|

|

|

|

Wayo |

|

|

|

|

|

Local Naka | Moderate - High |

|

|

|

|

Step 3: Products perceived value across the user's journey

To map out the driver's journey, we need to understand the subscription design first.

The subscription design are mentioned in the previous and section below:

- Segments we are charging from? Power Users; Core Users

- When will the segments change? We will look at the previous 2 weeks earnings of drivers and change the segment accordingly. The eligibility for the change is as follows:

Core Users: Earning >= 6k in the last two weeks

Power Users: Earning >= 3.5k in the last two weeks

- Amount charged from the sets:

Segment | Daily | Weekly |

|---|---|---|

Power Drivers | Rs. 99/day | Rs. 449/week |

Core Drivers | Rs. 49/day | Rs. 150/week |

Power Drivers:

The perceived value generated by the platform: >= Rs. 1000/day

Amount charged for that perceived value: Rs. 99/day

Core Drivers:

The perceived value generated by the platform: >= Rs. 600/day

Amount charged for that perceived value: Rs. 49/day

The partner, since the day he gets onboarded onto the platform, uses it for 15 days. If his last 15 days earnings >= 6k/week consecutively, he gets shown the subscription flow page

What to charge for?

In this section, we are trying to understand another fundamental question: What to charge for?

What is the core value prop of the product?

Wayo is On-Demand Intracity logistics platform that allows drivers {can be owners-cum-drivers or fleet owners} to get a stable source of income as per their availability and need. Also, the platform allows the drivers to withdraw their earnings instantly

The major category we are charging for is Output. The reason for the same is the driver is allowed to go online (as per their convenience) and receive orders. The greater the orders he completes, the greater are his earnings.

How much to charge?

To understand how much to charge, I have taken the unit economics of a driver and then build up the cost we are charging from him

Vehicle Unit Economics:

* This unit economics calculation is after speaking to 50+ drivers and taking median values for them

* This is for a 3W driver only

Total Monthly Cost: Total Fixed Cost + Total Variable Cost

Parameters | 3W | Assumptions |

|---|---|---|

No. of days | 26 | Assuming the driver takes off on Sundays |

No. of km/day | 80 |

|

Vehicle Price | 2,50,000 |

|

Fuel Type | Diesel | |

Diesel Price (Rs./L) | 87.67 |

|

Fixed Cost | 22000 | (A) + (B) |

Driver Salary (A) | 17000 |

|

EMI (B) | 5000 | Assuming:

|

Fuel Cost | 9141 |

|

Mileage (km/l) | 20 | |

Per km Cost (Rs/km) | 4 | |

Distance (km) | 2080 |

|

Maintenance Cost | 1040 | |

Per km Cost (Rs/km) | 0.5 |

|

Distance (km) | 2080 |

|

Total Cost | 32,181 | |

Extra Take Home | 15% |

|

Target - Take Home | 37,000 |

Target take home/day = ~Rs. 1400/day

Now, taking a look at the category wise pricing:

User category | Average earning/day | Suggested subscription amount/day | % Take Rate (/day) |

Power User | Rs. 2500/day | Rs. 99 | ~4% |

Core User | Rs. 1200/day | Rs. 49 | ~4% |

To keep the adoption lenient, we have started with a ~4% take rate initially. We are also looking at the last 15 days performance together and will then only segment the drivers into the above segments.

We are not charging anything from the casual and new users right now (proposed 4 weeks) as we would first want build perceived value of the platform.

The steps in a nutshell:

(Get onboarded >> Try the platform >> Get them used to it >> build a stable earning >> charge subscription)

Pricing Page Design:

The pricing page teardown with all the steps can be found in this document

This document covers the following points:

- Current Pricing Page Teardown

- Proposed Changes to the pricing pages

- Proper reasoning for the changes proposed

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.